FREE Resources - Leverage

To help advisors and investors better understand "forced savings" and the controversial subject of borrowing to invest, the following are some of Talbot Stevens' FREE educational resources on leveraging responsibly.

Software

Leverage Professional

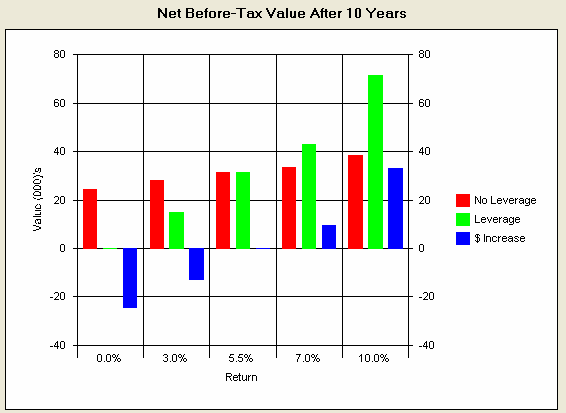

Talbot's Leverage Professional software allows you to do a personalized analysis of the net gains or losses for a range of returns so you get the full picture for your unique situation, for interest-only leverage, term loans, and RRSP loans. The brief, 1-page summary also reveals the minimum return needed for leverage to benefit you (be 'better than' not leveraging). Try our FREE evaluation version. More ...

Advisor Marketing Resources

To help advisors increase their business, Talbot has created the following marketing resources.

Top Tips for Advisors

Click here for Talbot's top ten suggestions for advisors when using leverage.

Talbot's Q&A for Advisors

Talbot has assembled common questions and answers related to marketing leverage responsibly here.

Prospecting Letters

These prospecting letters can introduce the concept, and find out who wants to learn more.

Checklists

Following Talbot's Responsible Leverage Checklist will significantly enhance the odds of benefiting from borrowing to invest. The Leverage Suitability Checklist helps advisors prove they have addressed key disclosure guidelines, and the Emotional Acid Test helps confirm if investors are emotionally ready for the potential downside of borrowing to invest.

Strategy Sheets

Talbot has written one-page Strategy Sheets on leveraging, that advisors are free to use as an education tool as long as authorship remains intact.

Leverage Strategy Sheets, Before 2000

- Conservative Leverage $165,000 Better Than RRSPs (June 1995)

- What is Conservative Leverage (July 1995)

- Leverage Breakeven Point Lower (July 1996)

- Leverage Risk Decreases Over Time (August 1996)

- When Leverage is Better Than Unleveraged Investing (January 1997)

- Dispelling the Myths of Leveraged Investing (May 1999)

- When Leveraging Equity Funds Makes Sense (June 1999)

Hide List

Leverage Strategy Sheets, After 1999

- Do You Use Power Tools (January 2000)

- Understanding and Dealing With Margin Calls (May 2000)

- Reducing the Risks of Borrowing to Invest (October 2000)

- Clarifying Tax Deductibility When Borrowing to Invest (May 2001)

- Is Conservative Leverage Less Risky Than No Leverage (October 2001)

Hide List

Related Products and Services

Articles

Talbot has written several columns for Investment Executive on borrowing to invest.

- Benefits of RRSP Catch-Up Loans (July 2001)

- Leverage a double-edged sword (August 2001)

- Low Interest Rates Fuel Interest in Borrowing to Invest (March 2002)

- Loan programs help clients maximize contributions (November 2003)

Concept Sheet

Talbot's Concept Sheets introduce a single concept, and can be used in a mailing or email, and also as a storyboard for discussing the concept with a client. Most of his Concept Sheets are part of the Leverage Marketing Package. The one on "Is Some Investment Debt Less Risky Than None?" is available free for distribution.

News Releases

The media is often interested in helping their markets understand the controversial subject of borrowing to invest. The following are some of Talbot's News Releases on the topic.

- Leverage Risk Lower Than You Think

- Conservative Leverage a Tax-Deduction Alternative to RRSPs

- Government Clarifies Leverage Deductibility

- Conservative Leverage Even Better Than RRSPs

- Margin Calls Highlight Need to Understand Conservative Leverage

- Is Conservative Leverage Less Risky Than No Leverage?"

- Can't Lose Leveraging Strategy