STRATEGY SHEET

September 2001

The Many Benefits of the

Efficient Frontier Theory

© Talbot Stevens

“The higher return, the higher the risk” is a belief that influences many investment decisions. But in numerous situations, it is actually possible to reduce risk while increasing returns.

Although the warning “if it sounds too good to be true, it probably is” is usually correct, there are exceptions.

One important exception for investors relates to the Efficient Frontier Theory, or EFT. This research is so significant that it earned a Nobel Prize and forms the foundation of most of the current thinking about constructing investment portfolios.

One of the key concepts of the Efficient Frontier Theory is that different types of investments often move in opposite directions. For example, bond investors know that when interest rates go up, the value of bonds goes down, and vice versa. This means that a portfolio of both bonds and cash fluctuates less — and is less risky — than 100% bonds or 100% cash.

Of the three asset classes, cash, bonds, and stocks, stocks fluctuate the most over short periods and are perceived to be the most risky. Like bonds, stocks generally increase in value when interest rates and the value of cash investments drop.

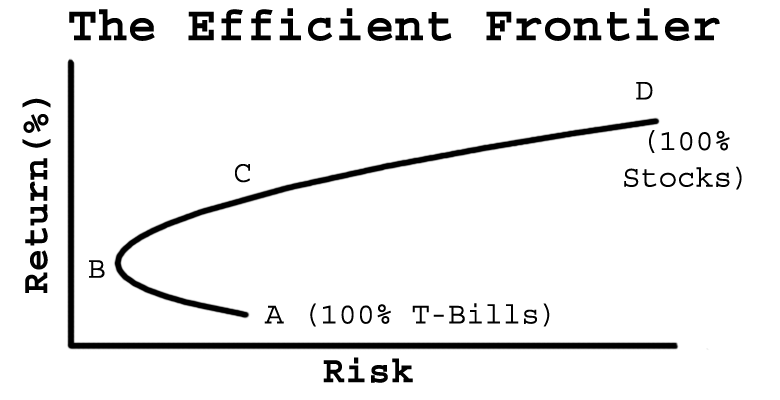

Many Canadians are very risk-averse, and like the security of guaranteed investments like GICs and Treasury Bills. On the graph, 100% T-Bills is represented by point A, resulting in the lowest returns and low risk.

Stocks produce higher returns in the long run, so we are not surprised that adding some stocks to the portfolio increases returns. But the significance of the theory is that risk decreases at the same time. This is because the value of stocks generally moves in the opposite direction as the value of T-Bills.

The combination of stocks and T-Bills at point B results in the least possible risk and a higher return than is possible with 100% T-Bills. C has the same risk as A, but produces higher returns, something that every investor wants.

The EFT shows how the key to reducing risk is to diversify with different asset classes. Ironically, “low-risk” portfolios of guaranteed investments can be made less risky by adding some “higher risk” stocks, with the bonus of producing higher returns at the same time.

To learn more about how your portfolio could be optimized to reduce risk and/or increase returns using the Efficient Frontier Theory, contact your advisor.